Today, we’re going to finish our blog series on vision-based disability claims. Last week, we covered Glaucoma and how individuals suffering from this condition can make sure they get the benefits they deserve. The second half of this series focuses on a couple of lesser known conditions that can also affect the quality of life of sufferers and prevent them from continuing in their occupations. If you suffer from one of the these conditions, following the tips below may help you get the benefits you deserve.

Macular Degeneration

Age-related macular degeneration is a condition which usually affects individuals over the age of 50, although rare cases have been reported in younger patients. Due to damage to the retina, macular degeneration can cause loss of vision in the center of your vision field, called the macula. This central loss of vision makes it difficult to do such activities as reading or recognizing faces, although enough peripheral vision is often present to allow the patient to participate in activities of daily life. The initial symptom is often yellow deposits, called drusen, in the retina. The larger and more prevalent the drusen are in the eye, the more likely an individual is to develop macular degeneration. Although it affects the central vision, macular degeneration doesn’t usually lead to complete blindness. The macula compromises only 2% of the retina, leaving the remaining 98% of the vision field unaffected. However, almost 50% of the visual cortex is devoted to processing macular information. In addition, losing central vision is extremely detrimental to basic visual tasks – reading is almost impossible and the loss of contrast sensitivity makes it more difficult to differentiate between colors, contours, and shadows.

Age-related macular degeneration is a condition which usually affects individuals over the age of 50, although rare cases have been reported in younger patients. Due to damage to the retina, macular degeneration can cause loss of vision in the center of your vision field, called the macula. This central loss of vision makes it difficult to do such activities as reading or recognizing faces, although enough peripheral vision is often present to allow the patient to participate in activities of daily life. The initial symptom is often yellow deposits, called drusen, in the retina. The larger and more prevalent the drusen are in the eye, the more likely an individual is to develop macular degeneration. Although it affects the central vision, macular degeneration doesn’t usually lead to complete blindness. The macula compromises only 2% of the retina, leaving the remaining 98% of the vision field unaffected. However, almost 50% of the visual cortex is devoted to processing macular information. In addition, losing central vision is extremely detrimental to basic visual tasks – reading is almost impossible and the loss of contrast sensitivity makes it more difficult to differentiate between colors, contours, and shadows.

There are several tests to determine if you have macular degeneration. These tests measure the presence and size of several different objects in the eye to tell if a patient has the symptoms of the disease. If these issues are present, then there are several different vision tests that can confirm the diagnosis. Once the diagnosis has been determined, the treatment usually consists of injection directly into the eye on a monthly or bimonthly basis. There is no permanent cure for macular degeneration at this time, so controlling the disease is the best choice at this time. In addition to the injections, adaptive devices such as special eyeglass lenses, computer screen readers, and accessible publishing options for books can make the daily life of sufferers easier.

There are several issues that insureds may face when filing a disability claim resulting from macular degeneration. The main issue is the fact that patients can still use their peripheral vision to see certain objects and continue basic daily life activities. Claims examiners can twist this ability into an argument that the insured is still able to perform their job duties. In cases where the insurance company uses surveillance, the activities on video can be taken out of context if the insured is going into public and completing tasks that may require some vision, but not the detailed abilities that a healthy macula provides. Anyone who is applying for disability benefits based upon macular degeneration should make sure to show how their job functions include tasks that require detailed vision to complete. Otherwise, this can result in an example of the disconnect between a diagnosis and a disability, discussed in one of our prior blog posts.

Retinitis Pigmentosa

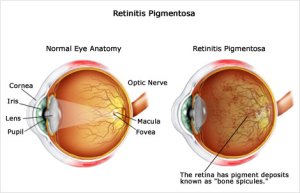

Retinitis pigmentosa is an inherited, degenerative eye disease that can cause severe vision impairment and often leads to blindness. It’s a very unpredictable disease, with some sufferers exhibiting symptoms from birth while others may not notice the condition until much later in life. It can also cause tunnel vision, night blindness, and a loss of central vision. Retinitis pigmentosa is caused by abnormalities in the retina, centered in either the photoreceptors or retinal pigment epithelium. There are no visual symptoms of the disease and sufferers must constantly adapt to less and less vision, eventually causing major issues with the activities of daily living.

Retinitis pigmentosa is an inherited, degenerative eye disease that can cause severe vision impairment and often leads to blindness. It’s a very unpredictable disease, with some sufferers exhibiting symptoms from birth while others may not notice the condition until much later in life. It can also cause tunnel vision, night blindness, and a loss of central vision. Retinitis pigmentosa is caused by abnormalities in the retina, centered in either the photoreceptors or retinal pigment epithelium. There are no visual symptoms of the disease and sufferers must constantly adapt to less and less vision, eventually causing major issues with the activities of daily living.

Testing for retinitis pigmentosa relies on documentation showing the continual loss of photoreceptor function through visual field testing. In addition, DNA testing is available to detect the presence of a number of different gene indicators that can give advance warning of the condition. After a patient is diagnosed with retinitis pigmentosa, there is little they can do. At this time, there is no cure for the condition, although some new treatments hold promise but aren’t yet widely accepted. Using vitamin A supplements can postpone blindness by years in some cases, and a retinal prosthesis is being tested in several European countries with promising results. Many sufferers of this condition maintain some form of central vision for a period of time. Some insurance companies have delayed (or denied) disability claims on this fact, asserting that claimants are still able to do sedentary work and work in conditions that don’t require seeing in low light. If you’re suffering from this condition, make sure that the diagnosis and evolution of your condition is well documented and substantiates how you’re prevented from performing your job duties even with “reasonable accommodations.”

Losing your vision is a scary though but is a reality for many people. The last thing someone who is losing or lost their normal vision to differentiate between light and shapes should have to worry about is their ability to collect the disability benefits they deserve. Some insurance companies use the uncertainty in many vision conditions to cast doubt on the claim and find reasons to delay or deny paying benefits. They will say that accommodations can be made even when they’re bordering being unreasonable. The ability of many low-vision claimants to continue doing things like going to the store and completing yard work makes insurance companies suspicious and surveillance videos seem like indictments.

If you’re considering filing a disability claim based off of a vision based disability or are being treated unfairly by the insurance company, please visit our website to sign up for a free consultation or call our offices toll-free at (855) 828-4100.

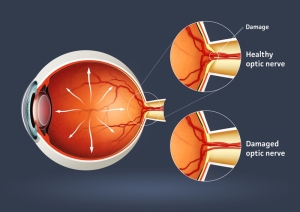

Glaucoma is not a specific disease itself but is the name for a group of diseases that affect the optic nerves and can cause blindness. In fact, glaucoma is the second-leading cause of blindness worldwide. It affects 1 out of every 200 people under the age of 50 and rarely exhibits any symptoms. The two main types of glaucoma are

Glaucoma is not a specific disease itself but is the name for a group of diseases that affect the optic nerves and can cause blindness. In fact, glaucoma is the second-leading cause of blindness worldwide. It affects 1 out of every 200 people under the age of 50 and rarely exhibits any symptoms. The two main types of glaucoma are